Condo Insurance in and around Dunnellon

Townhome owners of Dunnellon, State Farm has you covered.

Insure your condo with State Farm today

Home Is Where Your Heart Is

Because your condominium is so special to you, it makes sense to want to protect against the unexpected, which could include situations or damage due to theft or weight of ice. That's why State Farm offers coverage options that may be able to help protect your largest asset.

Townhome owners of Dunnellon, State Farm has you covered.

Insure your condo with State Farm today

Why Condo Owners In Dunnellon Choose State Farm

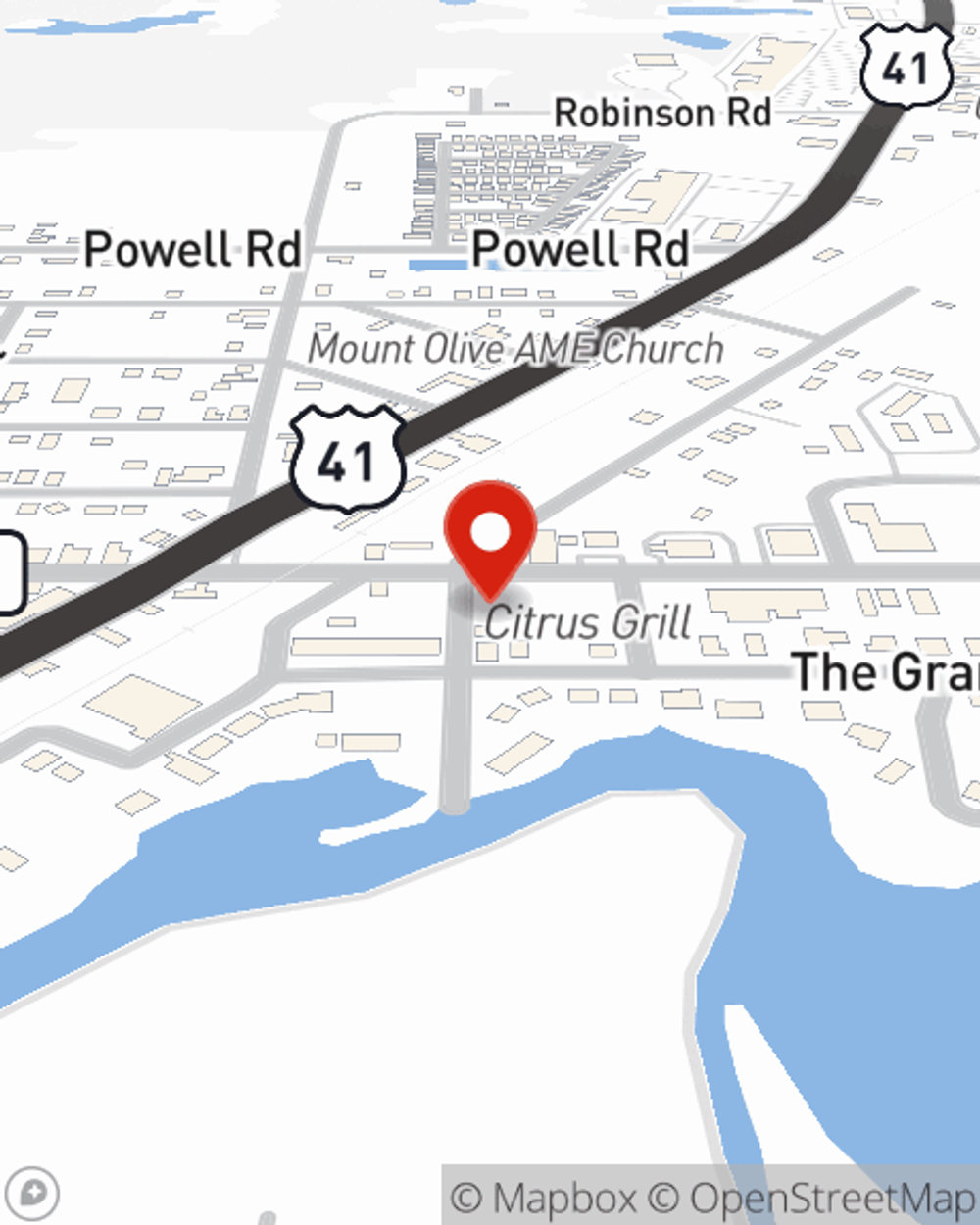

You can kick back with State Farm's Condo Unitowners Insurance knowing you are prepared for the unexpected with wonderful coverage that's right for you. State Farm agent Gigi Hunter can help you understand all the options, from replacement costs, possible discounts to a Personal Price Plan®.

Terrific coverage like this is why Dunnellon condo unitowners choose State Farm insurance. State Farm Agent Gigi Hunter can help offer options for the level of coverage you have in mind. If troubles like identity theft, wind and hail damage or drain backups find you, Agent Gigi Hunter can be there to assist you in submitting your claim.

Have More Questions About Condo Unitowners Insurance?

Call Gigi at (352) 489-8900 or visit our FAQ page.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

Gigi Hunter

State Farm® Insurance AgentSimple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.